EVENTS

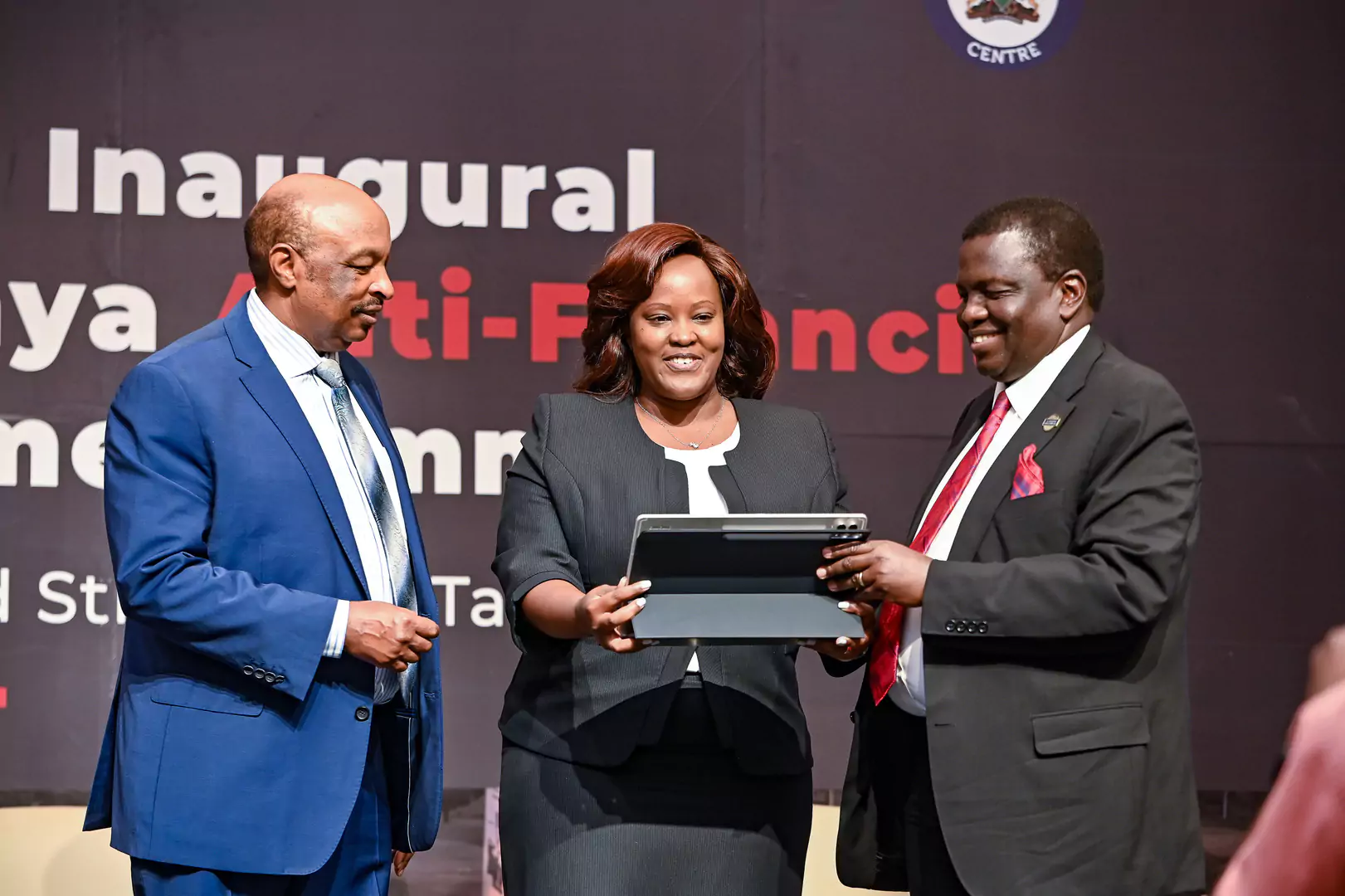

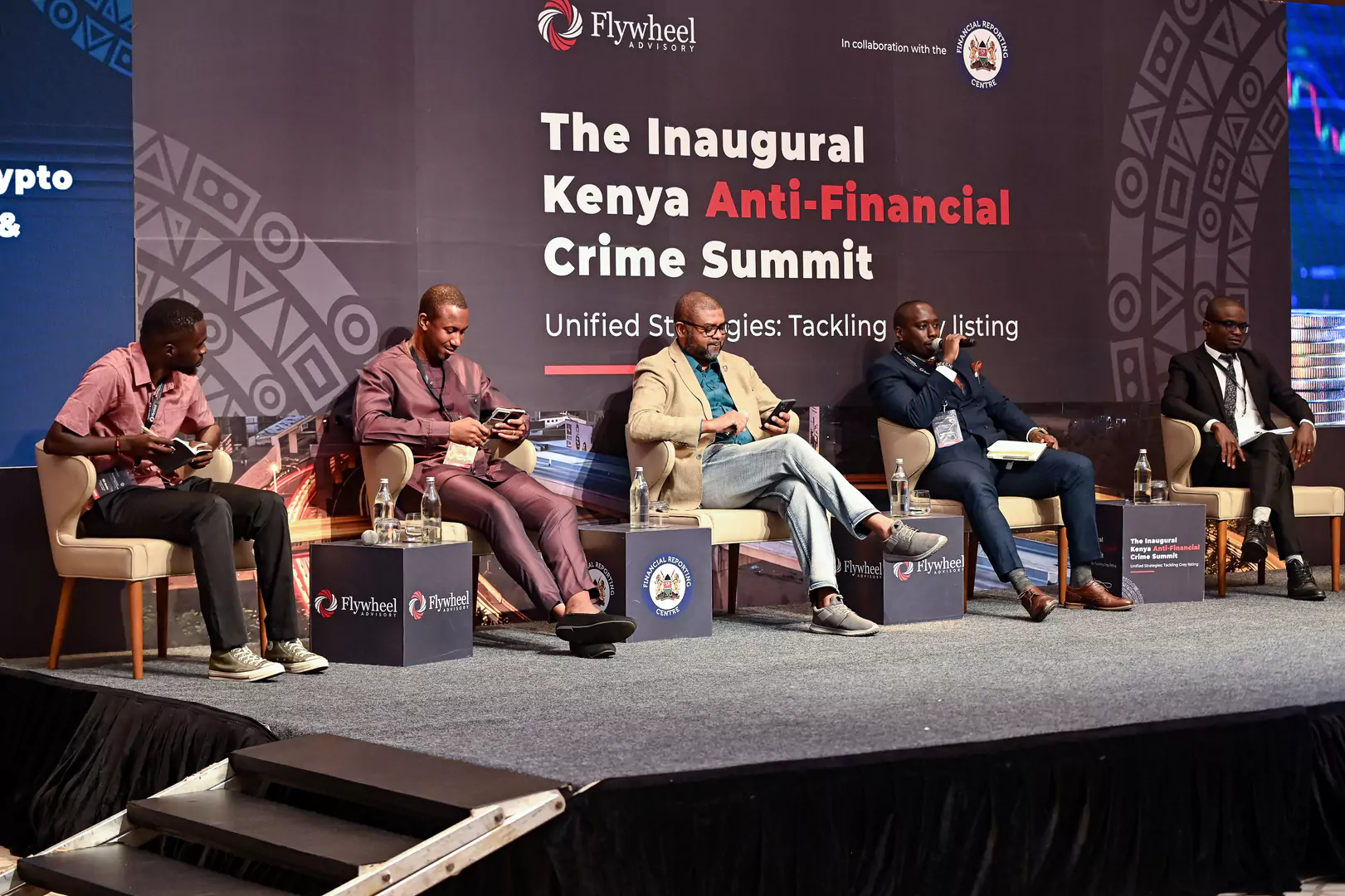

The Inaugural Kenya Anti-Financial Crime Summit

JW Marriott Hotel Nairobi, Kenya

Share:

Overview

Kenya’s recent inclusion on the Grey List of countries with deficiencies in their anti-money laundering, counter terrorist and proliferation financing (AML/CFT/CPF) frameworks has heightened the importance of robust compliance practices within the country’s financial industry among other pertinent sectors. Financial institutions and other AML reporting entities, supervised by the Financial Reporting Centre (FRC), play a pivotal role in addressing the identified deficiencies developing unified strategies to tackle Grey listing. This Summit is designed to provide these entities with a forum to share knowledge, tools, and strategies necessary to navigate compliance challenges posed by grey listing and thereby enhancing the efforts towards the urgent need of getting the country out of the Grey List.

Key Themes

Understanding Grey Listing: A comprehensive analysis of Kenya’s Grey-listing, its implications and

strategic path towards delisting.

Regulatory Compliance: Strategies for enhancing compliance frameworks to meet international

standards.

Multi-Sectoral Cooperation: Facilitating dialogue among different sectors to create a unified front

against financial crime.

Agenda

The agenda for this event is no longer available.

Speakers

Dr. Julius Kipng’etich

Group CEO

Jubilee Holdings Limited

Hon. Justice (Dr.) Smokin Wanjala, CBS

Judge

Supreme Court of Kenya

Saitoti Maika, MBS

Grace Mburu

Maina Chege

Sospeter Thiga

Ali Hussein

Sydney Asubo

Kananu Mutea

Atuweni-tupochile Agbermodji

Bernadette Nzomo

Edgar Tiltmann

Judy Kirichu

Philip Nyakundi Gichana

Robert Muoka

Eric Kivuva

Tabby Mugechi

Hon. Shakeel Shabbir Ahmed CBS

Sewe Wycklife, CCI

Hilda Gituro

Carole Kariuki

Joseph Mathenge

Eric Kiraithe, MBA

Felix Atandi

Prof. Peter Kagwanja

Wakesho Wegulo

Jackie Wahome

Simion Rutto

Sheila Masinde

Joshua Muteti Munyoki

Declan Galvin

Godwin Wangong’u

Andrew Bulemi

Antony Kiarahu

Fidelis Muia

Stephen Mwaura

Daniel Warutere

Raphael Mbaabu Anampiu

Hon. Justice Gikonyo

Bethuel Nsibande

Dr. Bright Gameli Mawudor

Bill Okoba

Judith T. Shamalla, MCIArb.

Elizabeth Duya

C.I George Aringo

Antony Mutisya

*Speakers subject to change up to the beginning of the event. This list will be updated periodically.

Sponsors & Partners

Sponsors

Flywheel Academy

LexisNexis® Risk Solutions

Collaborators & Partners

Financial Reporting Center

LSK Nairobi Branch

KASIB

PBORA

Mbaya & Associates LLP

Global Financial Integrity

ICIFA

APNAC Kenya

KEPSA

Betting Control and Licensing Board

Cyber Tembo

Kenya Judiciary Academy

*This list is subject to change up to the beginning of the event. This list will be updated periodically.

Book Now

*Registration period is closed as this event has passed.